We’re often warned against believing that “perception is reality,” but sometimes perception becomes the reality. In politics, it usually rises to the level of self-fulfilling prophesy.

The November 4 election results are a case in point, as “Affordability” carried the day as latest political buzzword:

- With power prices soaring, Democrats flipped two Georgia utility-regulator seats in rare statewide victories.

- In New York City, more than half of voters told exit pollsters that their top worry is the cost of living.

- Seven in 10 Americans say their grocery bills have gone up this past year.

- Six in 10 say their utility costs have increased.

During this time of year when spending is at its peak and you’re even more focused on making ends meet, it’s worth taking a look at why prices have increased. While gas and grocery costs have declined recently, those decreases don’t offset increases in other sectors:

- Utility costs continue to skyrocket.

- Health-insurance mandates have pushed premiums 2.5 times faster than inflation.

- Insurance regulations limit competition and hike premiums.

- Education financing policies have pushed college costs into unaffordable territory.

And so on and so on and so on…

You may ask: “What’s a common thread connecting the bulleted items above?” The answer is that they all bear an imprint of the greasy thumb of government.

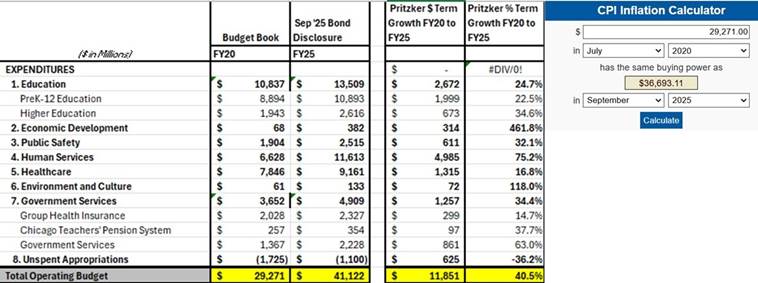

Here in Illinois, we need only look at the growth in state spending to see how much of your hard-earned money it has taken from you. This spreadsheet shows the increase in spending from Fiscal Year 2020 (Governor Pritzker’s first budget) through September 2025. On the right you’ll see that when adjusted for inflation, real spending increased by $7.4 billion, or 25%.

Remember all that money the Federal government was shoveling out the door during COVID? That money went a long way toward driving up prices because increasing the money supply into an economy where no one was making anything is the classic definition of inflation.

But the State did something even worse. It took the billions it received from Washington and instead of putting it toward debt reduction or capital projects, it was added to our operating budget. This established a new spending baseline, which meant that we’d be spending that same money year after year because as we all know, the cost of government programs never goes down. When the COVID money stopped, as we all knew it would, Illinois kept spending. It’s the gift that keeps on giving. (And where are those 4% spending reductions the Governor was telling his administrative agencies to prepare?)

We need look back no further than October’s veto session, where the Democrats who control the General Assembly bailed out the RTA ($2.5 billion), extended subsidies to the rent-seeking Environmental lobby for battery storage and “energy efficiency” programs ($8.0 billion) and decoupled the Illinois tax code from Federal law ($144 million and counting). Now we’re threatened with a cutoff of SNAP benefits because of our 11.4% error rate in determining eligibility. (I doubt that Walzian fraud is responsible for this, instead I choose to attribute it to an application of Hanlon’s Razor.)

Of course there are other reasons for our current crisis of affordability. The Trump tariffs are the largest US tax increase as a percent of GDP (0.47 percent for 2025) since 1993 and amount to an average tax increase per US household of $1,100 in 2025 and $1,400 in 2026. The US Supreme Court will soon decide whether the President’s claim that emergency powers under International Emergency Economic Powers Act (IEEPA) include the power to impose tariffs will be struck down, which commentators seem to think they will.

So who are you going to listen to: a guy who was born on third base and tells you he hit a triple trying to sell you a bill of goods about a progressive income tax or another guy who couldn’t even make money in the casino business who says that you aren’t paying the cost of tariffs out of your own pocket but also said that his tariffs might mean that kids must settle for fewer toys at Christmas? Decide for yourself if they’re creating a perception or ignoring reality.