Property taxes are never too far from the top of the list of things that concern Illinois taxpayers, and there is no shortage of proposals to lower them. As we search for ways to lower property taxes for everyone, I’m sponsoring a bill that will provide a measure of relief for low-income seniors.

I recently filed H.B. 4289, which provides low-income seniors with a small amount of relief from high property taxes through the income tax code.

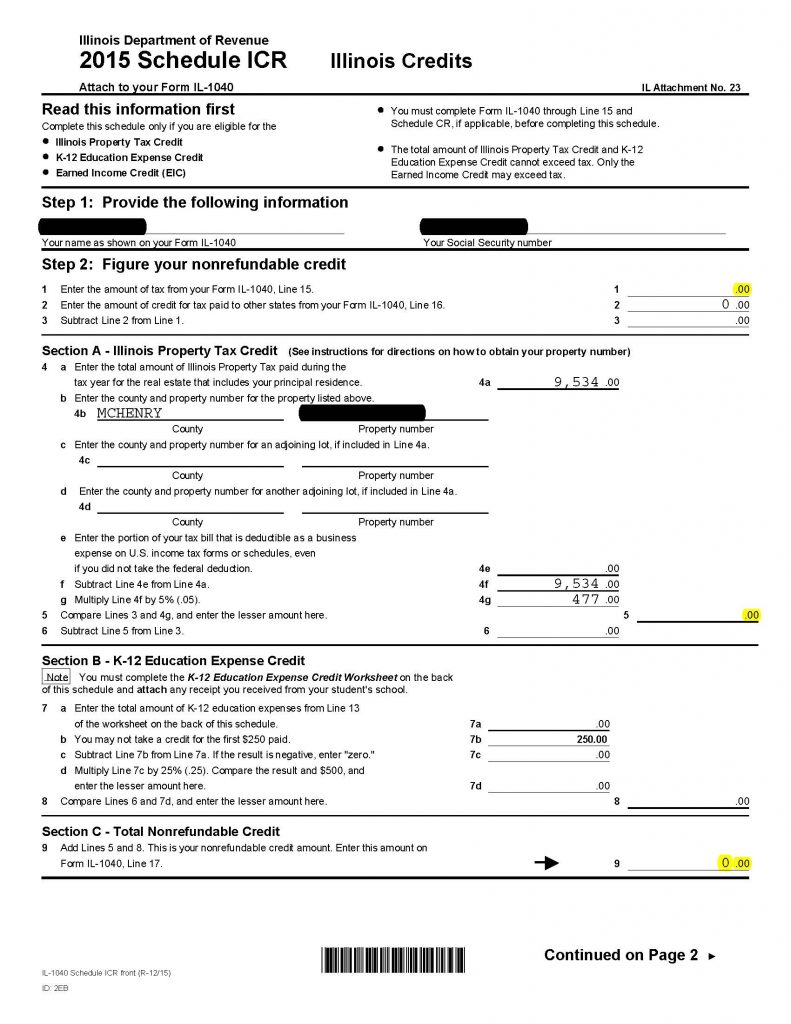

If you take a look at the tax form above, you’ll see that there’s a credit (a dollar-for-dollar reduction of tax) equal to 5% of your home’s property tax bill that you can claim to reduce your income tax liability. For instance, if your property tax bill is $5,000, you can claim a $250 credit against that liability.

However, the credit is “non-refundable”, which, as is stated in Publication 108 from the Illinois Department of Revenue:

“If your property tax credit exceeds the tax you owe, you may not receive a refund for that amount, and you may not carry unused credit to other years. Your property tax credit may only reduce the tax you owe to zero.”

The problem for most retirees, however, is that since Illinois doesn’t tax retirement income or social security, they don’t pay any state income tax. All retirement income taxed on their Federal returns is shown as a subtraction on their Illinois returns, often leaving them with zero taxable state income. Thus, the credit offers no relief to offset their ever-escalating property tax bill.

H.B. 4289 allows the credit to become refundable for anyone age 65 or over whose Federal adjusted gross income (the starting point for calculating Illinois taxable income) is below $50,000. This would allow those seniors most affected by rising property taxes to gain some measure of relief.

The image at the top of this post is from the tax return of a client of mine whose adjusted gross income in 2015 (it’s not changed since then) was a little under $50,000, consisting mostly of a private pension, IRA distributions and social security and who paid over $9,500 in property taxes. Had the credit been refundable, my client would’ve gotten a state tax refund of $477. Not a lot, but this refund could help pay a utility bill, buy groceries or pay for prescriptions.

Until we have real property tax relief for everyone, which can only come when we change the way we pay for education in this state, measures such as this will at least help those most in peril of losing their homes some small respite.

###