In my last Reick Report, I wrote to you about the abbreviated and unproductive Veto Session that we endured in November that you paid for. There were no vetoes to be considered and there was no action on the serious issues that voters highlighted as concerns in the election. So, after a few unproductive days in the legislature that wasted taxpayer dollars, we took a vote to adjourn.

The problem? The vote wasn’t to adjourn “sine die,” meaning we would conclude our work and return after the swearing in of the 104th General Assembly. Instead, we voted to adjourn and come back to Springfield before inauguration in what is known as a “Lame Duck” session.

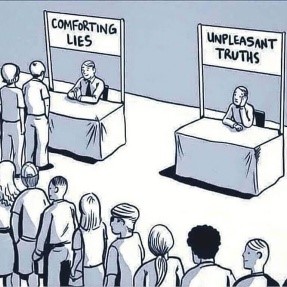

The term “Lame Duck” applies to someone whose capabilities are limited and whose days are numbered because the member either did not run for re-election or lost in November. (Click here for a fuller explanation). The election is over, and the new General Assembly members are not yet sworn in. This means that legislators who either lost re-election or who chose not to run can take controversial votes and then leave the legislature with no accountability.

This lack of accountability is made worse by the math of Lame Duck vote thresholds. At the risk of getting too technical, the way the legislative calendar works in mysterious ways. During Veto Session, a supermajority of 71 votes is needed to pass any legislation. After January 1st (during Lame Duck Session), it only requires a simple majority to pass a bill – or 60 votes. This difference in the voting threshold means that it’s much easier for the legislature to pass controversial legislation without as much accountability, all the while giving the lame ducks the freedom to vote their conscience instead of how they’d have voted if they had to account for that vote.

Lame Duck sessions should not be allowed. They have historically been the times when the most controversial legislation is passed, usually with very little public deliberation or debate. Lame Duck sessions bring out the worst instincts in the majority party and go against basic tenets of transparency and accountability.

So what does this mean for taxpayers?

As families across Illinois are preparing for the holidays, I suspect that the supermajority in Springfield is behind closed doors crafting expensive and out-of-touch legislation. It could take the form of tax increases or fund sweeps to bail out Chicago, attempts to take money from the Road Fund to bail out mass transit, and any legislation aimed at changing our pension system. But trust me, anything that happens in Lame Duck will be bad for taxpayers.

This is all within the context of the out-of-control appetite for spending in Springfield. In 2018, the Illinois state budget was $36 billion (around $45 billion in today’s dollars adjusted for inflation). This year’s budget, at over $50 billion that relied on a tax increase, means that state spending is far outpacing inflation and putting more of a squeeze on taxpayers. And even with that tax increase, we’re still facing a $3 billion deficit in the upcoming budget year and a $730 million shortfall in mass transit funding.

Lame Duck Pension Reform?

One issue that could be on the table this year in Lame Duck is pensions. They’ve done it before. Illinois’ pension crisis is the most significant challenge we face. You’re probably sick of hearing me talk about it, but any attempt to address changes to our pension system can’t be done overnight and under the bum’s rush of Lame Duck. Yet, there’s a real danger that reforms or adjustments might be introduced and passed during this Lame Duck session without the due diligence that taxpayers and retirees deserve.

Wait, Illinois is Behind Again?

In my last newsletter, I highlighted a report from the Governor’s Office of Management and Budget that warned of bad economic indicators in Illinois. This week, there’s even more bad news for Illinois’ economy. In a few “feel good” news stories, the Governor’s office attempted to put a positive spin on the predicted upcoming recession in Illinois saying that Illinois is better prepared to handle a recession than we have been in the past. However, the real highlight of one article was buried at the bottom:

“[A] separate report from COGFA showed Illinois lags the nation in new job growth when compared to pre-pandemic job levels in fall 2019. The state has recovered all the jobs lost during the pandemic, but has only added about 29,000 jobs since October 2019, an increase of 0.5% compared to the national rate of 4.9%, according to COGFA Chief Economist Benjamin Varner.”

Illinois’ job growth numbers are abysmal. When you dig into the numbers in the COGFA report, the news is even worse. Most of the job gains are in government and the public sector. That means that our private sector is creating jobs at a rate even slower than those numbers reflect.

I don’t set out each week in this newsletter to be the bearer of bad news, but I have enough respect for my constituents to think that you’re reading this because you want to know the true state of affairs here in Illinois. One thing I’ve noticed in the past eight years is that there’s a wide chasm between the way that the news portrays Illinois and the way people feel Illinois is headed. I think the last election confirmed that feeling.

If we want to truly make a difference in this state, we need to first acknowledge the challenges honestly and work together to find solutions. Illinois being at the bottom of lists isn’t new, but I’ll keep calling it out until there is a real effort to reverse the trend.

Last-Minute Gifts and Last-Minute Christmas Trees

There’s still time to get your tree! A wonderful family tradition this time of year is putting the kids and the dog in the car and going out to cut your own Christmas tree. Trust me when I tell you this: these memories will remain long after the kids are grown and gone, so take advantage of the opportunities to create those memories while you can.

Did you know there are more Christmas trees in McHenry County than anywhere else in Illinois? Naturally McHenry County has a list of local Christmas tree farms for you to choose from!

You can also grab some locally made goodies for a last-minute gift idea or to take to your next holiday gathering. From locally made candy, to craft beer and experiences, here is a list of products made right here in McHenry County!

This will be my last Reick Report for the year, so I want to take this opportunity to wish you a Merry Christmas and a Happy New Year. As the year winds down, take the time to look around and count your blessings. Hold those you love close to you and extend some help to those who have less, for by doing so your blessings will be multiplied.

Peace.