This week, we were back in Springfield for the Veto Session – traditionally a time when the legislature can take up the Governor’s vetoes. Unfortunately, it’s recently been used as a time to push through controversial legislation. In this report, I’ll give you a short update on what happened this week (spoiler alert: nothing), details on our state’s financial situation, and some background on why there is finger pointing going on about rising power bills. Thanks again for reading this update and I hope you find it informative and helpful.

Veto Session and JCAR

This week we convened at 3:00-ish on Tuesday, read one resolution and adjourned. On Wednesday we had a bunch of “Points of Personal Privilege” and went home within an hour of convening, a total waste of time. While there was a lot of talk about potential legislation to be filed and voted on in the Veto Session, nothing has yet been finalized. I expect that there could be more action next week.

However, there were rallies under the dome this week advocating for changes to the Tier 2 pension system in Illinois. As I have written to you (at possibly too great a length) before, in order to do right by the affected employees enrolled within the Tier 2 pension system and to do right by the taxpayers of Illinois, changes must be made to the Tier 2 system to make sure that it meets the federal safe harbor provisions. I am working collaboratively to get this done. In fact, last year during the veto session, I wrote about the collaborative approach I hoped would get us to a solution before today. However, my concern remains is that to get this passed, too many pension sweeteners will be added to the legislation and the scale will be tipped in favor of only benefiting those enrolled in the pension system and taxpayers will again be on the hook for ever increasing pension obligations.

The Joint Committee on Administrative Rules (JCAR) met again this week. I have the privilege of serving on JCAR – a bipartisan, bicameral legislative panel tasked with overseeing any new or updated administrative rules. This month our topic of conversation centered primarily on industrial hemp with our next meeting scheduled for December. You can always find information on our meetings at JCAR’s website.

Wait, Who Is Responsible for the High Utility Bills?

As temperatures dip, we are beginning to see our utility bills go up, again. Everything is becoming more expensive, and I hear from more and more constituents about the tough financial decisions they are having to make as they balance the costs of medicine, food, utilities, and healthcare, and property taxes. This pain is being felt across the state. Unfortunately instead of it leading to a bipartisan effort to address the root causes of cost increases, it has led to finger pointing.

A couple of weeks ago, JB Pritzker along with four other Democratic Governors sent a letter to PJM – a regional organization that manages the wholesale electricity market in parts of the Midwest, Mid-Atlantic, and South. In the letter, the governors called for “PJM to take urgent action to address the increasing cost of electricity bills.” You can read the whole letter here, but here’s the Cliffs Notes version of the letter: While the Governors accept that their anti-carbon energy production policies coupled with their pro-electrification policies have increased demand and decreased supply (commonly known as “Econ 101” for the benefit of all the “name your favorite social-cause studies” majors out there) *maybe* contributed to the cost increases, they lay out demands for PJM to fix the price hikes they caused.

It’s rich to see such posturing from Governor Pritzker. He passed and signed legislation that forced the elimination of a large portion of our base-load energy generation capacity while providing exorbitant subsidies for unreliable and expensive “green” energy, not to mention the subsidies allowing rich people to buy electric cars. Pritzker’s policies are going to eliminate the one major thing that will attract new business to Illinois: reliable and relatively inexpensive electrical power, and when the prophesies of the Green Revolution fail, angry letters from him trying to deflect blame aren’t going to change that.

Budget Woes are Back Again

As state legislators in the minority party have been warning for years, the gravy train of “free” taxpayer money from the federal government is over, yet the appetite for spending by the majority in Springfield continues to grow. Over the past few years, the majority party in Springfield has passed state budgets with spending growth that has outpaced state revenue growth leading up to the inevitable budget deficit that two government agencies are warning about now.

There are two budget-focused agencies within state government – one that sits within the legislative branch (Commission on Government Forecasting and Accountability or COGFA) and one within the executive branch (Governor’s Office of Management and Budget or GOMB). This dual system allows for better checks and balances and accountability. While COGFA and GOMB don’t always agree on the expected revenue, spending, or other aspects of the state’s finances, they do agree that Illinois is facing some major financial challenges this year.

In their most recent report, COGFA highlights the ongoing fiscal challenges Illinois is facing. While some revenue streams slightly exceeded their previous forecasts, overall, the state’s “General Funds receipts through the first third of FY 2025 are now down $502 million as compared to the first four months” of last year. This is not good news for this year and the news gets worse for next year, as COGFA anticipates a deficit next year of $3.173 billion, driven by pension and healthcare costs. They then project that at current spending levels, there will be worsening deficits through FY30.

GOMB similarly published its annual economic forecast report that showed warning signs of Illinois’ impending financial challenges. The report notes that the “state economy is showing signs of slowing in areas such as employment and consumer spending. Prices for rent, energy, and food have all increased year-over-year, at both the state and national level. Salaries and average wages have increased but not kept pace with rising costs.”

The report highlights a few inconvenient truths:

- Our productivity is slowing

- Our labor market lags behind the national average

- State revenue growth is slowing

Now that we have the data, it is time to make decisions. When faced with a budget deficit, there are three options on the menu for policy makers – cut spending, increase taxes, and pursue economic growth policies. Too often, those in power in Springfield have chosen only to increase taxes as a way to dig out of our financial hole. It hasn’t worked. Our growing pension obligations, coupled with the insatiable appetite for new programs and new spending in the legislature led us here and we cannot tax our way out of it. We cannot double down on the dangerous policies that brought us to this point.

I’m calling on my colleagues to do the hard work of looking at each government program to find where we are maximizing our taxpayer dollars and where we can find cuts. We need to pursue policies that will spur economic growth to reverse the decline we are experiencing. And I’m calling on my colleagues to pledge that they will not raise taxes on Illinois families to patch up their budget deficit.

Thanksgiving Food Drive and Helping the Families Impacted by the recent Apartment Fire

As Thanksgiving approaches, it’s not too early to remind everyone that the Woodstock Rotary Club is once again gearing up for its annual Christmas Clearing House. I’ll have more info as the weeks go on.

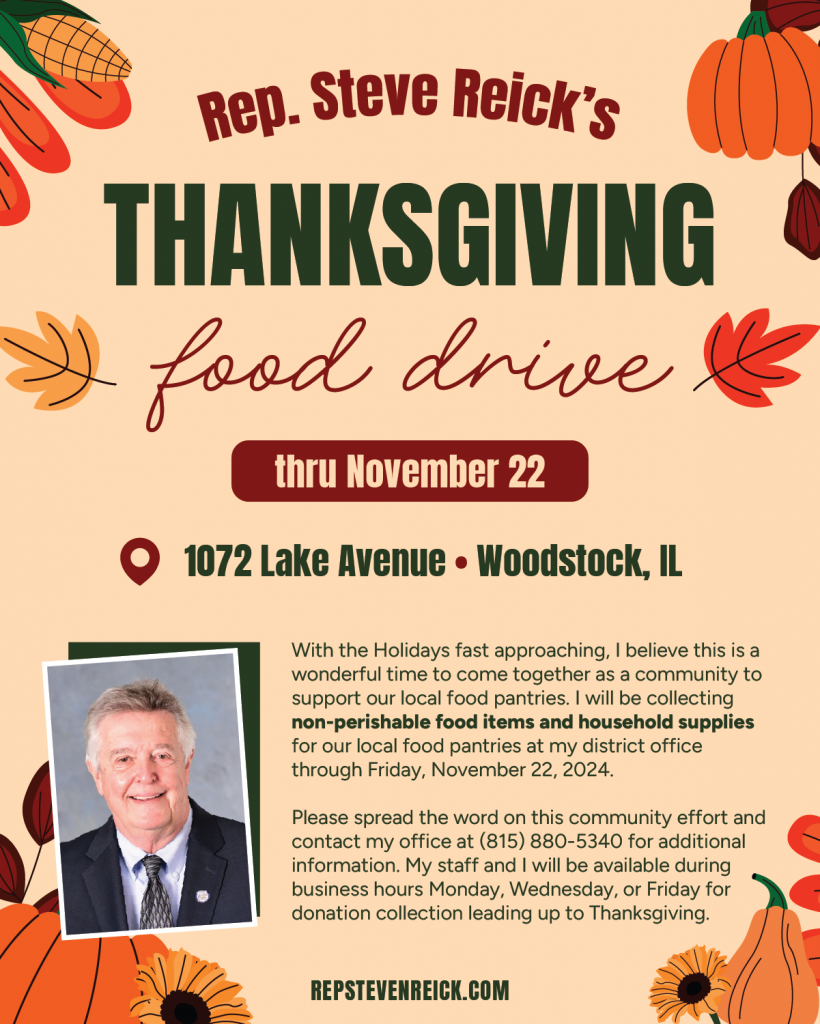

This year my office is again hosting a Thanksgiving Food Drive. If you are able, please consider giving donation of non-perishable food items for families who otherwise may not be able to put a Thanksgiving meal on the table this year. All donations will find their way to local food banks. You can find more details about the drive below. We’ve also added a bin outside our office door to make it more convenient for people to drop off food before or after office hours.

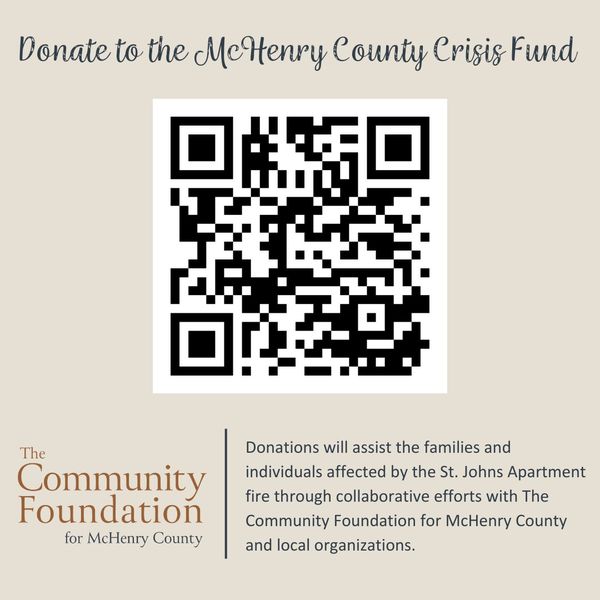

In addition to collecting food items for the holidays, I’ll be accepting donations for relief of the families displaced by the recent apartment fire on St. John’s Road. You can also make a financial donation through the Community Foundation for McHenry County. See below for their press release and QR Code to donate. This is what our community does best. It’s time to step up again.

Christmas Tree Time

A wonderful family tradition this time of year is putting up a Christmas tree. This year, are you considering a local tree? There are plenty of local opportunities to visit a local tree farm with the family, choose the perfect tree, and enjoy the beauty and scent of a fresh tree throughout the holidays.

Did you know there are more Christmas trees in McHenry County than anywhere else in Illinois? Naturally McHenry County has a list of local Christmas tree farms for you to choose from!