Though National Food Bank Day, a day where we recognize the important work of Food Banks in every community to serve food insecure families, was on September 6th, every day can be considered Food Bank Day. With inflation having caused the incredible rise in grocery prices, many more families are experiencing food insecurity. In this week’s Report, I’ll touch on some of the local efforts to support our Food Banks. There is also a policy component to this topic, and I’ll re-share an article I wrote.

Opportunities to Support Local Food Banks

Our office hosts regular food drives for local food banks. I am always struck by both the generosity of people and the true needs we have in our communities. At our shred event we collected over 100 pounds of non-perishable items that we donated to the Wonder Lake Neighbors Food Pantry. I also know that they constantly have a need for fresh meat. Especially with today’s meat prices, many families struggle to put healthy protein options on their plates. In August I bought a pig at the County Fair 4-H Auction which I donated to the food pantry last week.

Beyond donations, every food bank needs volunteers. We have some wonderful local food pantries filled with top notch staff and volunteers who work extremely hard to keep our community members served! If you are looking for a way to give time, money, or food donations to a local food pantry but need to know how, please let our office know and we would love to get you connected. With the holidays coming up, the need becomes more acute. The Butterball Gift Check Program, which I’ve participated in for the past 4 years, is a great way to help your neighbors in need. Finally, please consider donating to programs like this one that provide holiday meals to families who could otherwise go without.

Also, if you are someone who is experiencing food insecurity, help is available with no questions asked. Just call or drop by and we’ll get you connected.

Hot Topic of the Week: Will We Now Pay More for Groceries?

This week’s Hot Topic of the Week is a repeat. I’ve seen many people talking about the repeal of the 1% grocery tax and touting it as a cure-all for the inflation families are facing at the grocery store. So, this week I’m dusting off an article from a couple of months ago that explains exactly what was in that legislation and why it may actually mean that your grocery bills will go up.

Here you go:

In his State of the State speech in February, Governor Pritzker proposed getting rid of the 1% sales tax on groceries. With inflation having driven up food prices 25% since 2020, repealing this tax was a popular proposal among Illinois families and one which didn’t cost the state a dime.

Here’s why: the current Illinois grocery tax of 1% is set by the State but those tax dollars go to local governments. When Governor Pritzker proposed getting rid of the grocery tax, local government officials were furious because after cutting the Local Government Distributive Fund (LGDF) and the Personal Property Replacement Tax (PPRT) reimbursement, this blatantly political gimmick was one more effort by the Governor to strangle the budgets of local governments because he’d be able to say he “cut taxes” without having to cut any spending or make up the difference.

I wonder if the Governor’s people asked voters what they thought of a policy that would increase their grocery tax? I don’t need a public opinion poll to know that idea would be terribly unpopular. At a time when families are paying more for groceries than ever before, how could any politician consider increasing taxes on groceries? But they found a way.

In an effort to keep its campaign message of cutting grocery taxes alive, the Pritzker administration worked out a deal with local governments. The statewide grocery tax would be eliminated but local governments (including non “home-rule” communities) would be able to enact their own grocery tax without a voter referendum. In addition, non home-rule communities would be able to enact an additional 1% sales tax, not only on groceries but on all otherwise taxable sales, again without going to referendum.

The bill to “Eliminate the Grocery Tax” passed overwhelmingly and I’m sure there are plenty of people ready to run ads across the state talking about how they “cut taxes on groceries.”

Only in Springfield can a “tax cut” law in reality mean a 200% increase in that same tax. People are so tired of this political double-speak. That’s why I voted “No”. You deserve real relief from price increases – this new law does the opposite.

The results of this politically motivated “talking point” legislation will mean that some families will pay more in grocery taxes than they did before it passed. Too many families are having a hard enough time paying for groceries already. It is immoral to promise them relief and deliver higher costs.

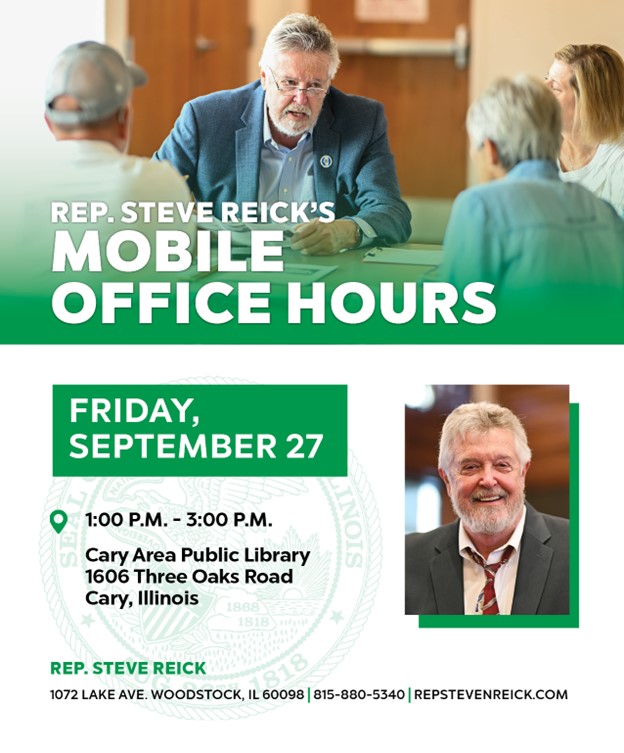

Mobile Office Hours

This Friday we are holding mobile office hours in Cary from 1:00-3:00pm. Stop by if you have questions or need assistance with a state agency. You can find more details below:

Around McHenry County

It’s Apple Picking Season

We have officially entered Fall. If you’re looking for something to enjoy with your family locally, there are apple orchards, corn mazes, and Fall fun all around McHenry County. Check out these links from Naturally McHenry County for some highlights of fall activities as well as local apple orchards to visit!

https://www.naturallymchenrycounty.com/things-to-do/farms-u-picks/apples

https://www.naturallymchenrycounty.com/blog/post/fall-family-fun-in-mchenry-county-il

Like what you see? Please share this update with your friends and family. If someone forwarded this e-mail to you, please sign up for my newsletter or send me a message by clicking here: https://repstevenreick.com/contact/. With this weekly Reick Report, I aim to give you a quick and easily digestible update on what is happening at the State Capitol, the top issues in our local area, and how you can get engaged.