During last week’s annual Budget Address and State of the State Speech the Governor proposed an increase nearly $2.3 billion in spending over last year. While his revenue estimate results in what he calls a $298 million surplus, $900 million of that revenue estimate consists of statutory changes that are not yet in effect and $175 million in what could only be described as highway robbery. Without this, we’re looking at a $775 million deficit in the 2025 budget year (which begins on July 1). In addition, we got to hear a not-so-veiled plug for his own “In Case of Emergency, Break Glass” Presidential campaign.

As Federal funding has dried up and state revenue has slowed, the pace of government spending growth should follow suit. Instead, our Governor likes to “Think Big” (mainly on government spending), and he’s been forced to find gimmicky methods to “balance” his bloated budget, methods which he says save money for taxpayers, but in fact do nothing of the kind.

In this week’s newsletter, I’m going to focus on a few of the things that will give you a better example of what I’m talking about.

Hot Topic of the Week: Wishful Thinking, Shifting Tax Burdens and Highway Robbery

The $1 billion the Governor proposes in the way of “Revenue Enhancements” which will require legislative approval and which he says will help balance the budget are:

- $526 million in changes to the net operating loss rules on businesses. Without getting too much into the weeds on this, through fiscal year 2024 corporations have been allowed to deduct up to $100,000 of net operating losses against other income. Under current law that limitation was set to expire this year. The governor has proposed that rather than eliminating the cap entirely, the limitation be increased to $500,000, which he characterizes as a benefit to businesses. However, those businesses which have losses greater than $500,000 are being forced to carry forward losses that they would otherwise be able to deduct resulting in more revenue for the State.

- Capping the “Retailer’s Discount” at $1,000 per month. Currently, Illinois retailers are allowed to keep 1.75% of the sales taxes they collect on behalf of state and local governments through what’s called the Retailers Discount, which is intended to reimburse them for the cost of collecting taxes on behalf of the State. This change will increase general funds to the State by $101 million.

- Other revenue enhancements consist of increasing sports wagering tax ($200 million) and limiting the standard deduction on personal income taxes ($93 million).

Another gimmick being used to plug the budget gap is to raid the Road Fund, taking $175 million and applying it to mass transit instead of taking the money out of General Revenue where it normally comes from.

Why does this matter? We need look no further than IDOT’s project to widen Route 47 through Woodstock, which has been in the planning stage for years. In 2019, the cost to relocate the utilities in the roadway was bid at $6 million. Last week IDOT came back with a revised bid, estimating that it will now cost $16 million to relocate the utilities, and that increase is due entirely to inflation. This is happening to projects all throughout the state.

While this diversion of Road Fund money to mass transit is not technically outlawed, it’s being used as an additional source of revenue so that $175 million of General Revenue can be put to other purposes, such as the $181 million the Governor has budgeted for migrant relief. The Governor has no business diverting these funds. I spoke about it here.

Finally, the governor got a huge round of applause when he said he wanted to eliminate the 1% tax on groceries. What he failed to mention was the fact that this is not a tax cut, it’s a shift. This tax does not go to the state, it stays in the municipality where it’s collected. By eliminating the sales tax, the governor has done nothing more than shift the burden of paying for local services to property tax owners. The state already shortchanges local governments by not paying the full amount it should be paying to them through the Local Government Distributive Fund. Now, the governor is trying to score political points by adding an additional burden on local property taxpayers. You can see my comments on this matter by clicking here.

In Case of Emergency, Break Glass

When I was in law school at the University of Georgia in the 1970’s, Jimmy Carter had just been elected President. I don’t know how many people I spoke to who said that they were happy to vote for him for President just to get him out of the state of Georgia. From the comments he made at the conclusion of his speech, I think we heard the kickoff of his “In Case of Emergency, Break Glass” Presidential campaign.

Get Involved – File a Witness Slip on a Bill You Care About

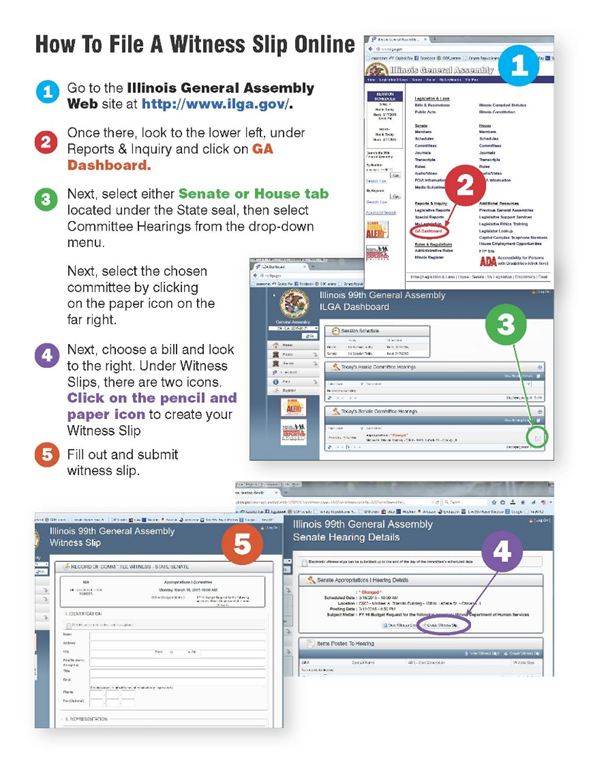

Every year thousands of pieces of legislation are filed – some are good and some are really bad. I get an awful lot of emails from constituents telling me to support or oppose particular bills. You can add your voice to the process by filing a witness slip on the General Assembly’s website. It’s an easy and effective way to get involved and for you to have a say in whether bills get passed or not. We pay attention to these things. For example, H.B.1634, a really, really bad bill which would in effect adopt California carbon emissions standards and have a devastating effect on Illinois’ farms and businesses. 3,746 opponents filed witness slips before a committee hearing and as a result the bill is not going to come up for a vote. Click here for a YouTube video that will walk you through the steps on how to file a witness slip.

Stay Up to Date:

Like what you see? Please share this update with your friends and family. If someone forwarded this e-mail to you, please sign up for my newsletter or send me a message by clicking here: https://www.ilhousegop.org/contactreick. With this weekly Reick Report, I aim to give you a quick and easily digestible update on what is happening at the State Capitol, the top issues in our local area, and how you can get engaged.