Governor Pritzker’s Tax, Borrow & Spend Budget More of the Same From Failed Democrat Playbook

I was also incredibly disappointed by the Governor’s refusal to seek real reforms to our pension crisis. Rather than choosing a responsible path forward to address pension debt, he reverted the old standby budget gimmick of extending the pension ramp. By extending this massive debt by seven additional years, he is able to identify close to $900 million that can be spent on new programs in FY 2020. That money on the front end is far outweighed by additional interest that will end up costing taxpayers tens of billions or more in new debt. It is precisely this “kicking of the can down the road” that created Illinois’ pension crisis in the first place.

These Coffee & Conversation events compliment an already-existing mobile office hours tour that brings district office resources to local libraries and municipal buildings throughout the 63rd District. By offering a variety of opportunities for public engagement, I am hoping to maximize the access residents have to their elected Representative in Springfield.

Rep. Reick Joins House Republicans in Opposing 82% Increase in Minimum Wage

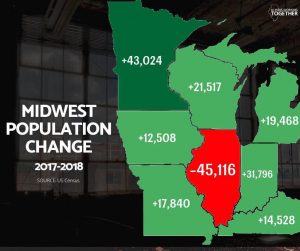

Minimum Wage Hike: Bad for Business, Bad for Low-Wage Workers; Great for Neighboring States

Numerous studies have demonstrated that increasing the minimum wage leads to job losses for low-wage workers. After Illinois raised its minimum wage in 2010, unemployment among teenagers and part-time workers went up. No wage is enough if there isn’t an opportunity for a job.

Business owners cannot simply absorb the higher cost of doing business. They are forced to cut their workforce or go out of business. Businesses also have a limited ability to raise prices to make up for the cost of a higher minimum wage. Two-thirds of Illinois’ population lives within a 40-minute drive of the state border. With higher gas, liquor, tobacco and sales taxes, this will create yet another reason for these people to shop across the border.

The effective date of this bill would not have changed if Democrats would have slowed down, listened to valid concerns, and ensured that the best bill possible was sent to the Governor. But for reasons that were purely political and which had nothing at all to do with good public policy, this bill moved at rocket-speed to the Governor.

The House vote on the minimum wage bill was 69-47-1. The measure has already been signed into law.

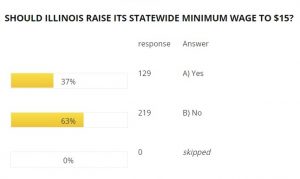

District 63 Survey: Reject Minimum Wage Hike

Beware of Tax Season Identity Theft Scams!

The Illinois CPA Society has published tips on how people can avoid becoming a victim of identity fraud during tax season. Whether scam artists use your information to file tax returns with hopes of stealing your refund or pose as IRS agents who threaten legal action if payments are not made, there are steps that can be taken to protect yourself from these predators.

The Illinois CPA Society has outlined key points to help ensure you don’t become a victim:

Tax ID Theft Warning Signs

- Your electronically filed tax return is rejected because a return with your Social Security Number already has been filed

- Receiving a letter from the IRS asking for confirmation on submission of a tax return being held for review

- Being informed by the IRS that records of wages were received from an employer that you did not work for

Tax ID Theft Prevention Steps

- File your tax return as early as possible

- Arrange for your tax information forms to be delivered to you electronically during tax season (W-2s, 1099s, etc.)

- Monitor your credit report for unusual activity

- Avoid using public wi-fi Internet connections to send private information

- Shred old financial documents

- Make sure to encrypt any tax information sent via email with a password

Rep. Reick Offers Free Passes to Many Chicagoland Museums and Zoos

- Adler Planetarium

- The Art Institute of Chicago

- Brookfield Zoo

- Chicago Botanic Garden

- Chicago Children’s Museum

- Chicago History Museum

- DuSable Museum of African American History

- The Field Museum

- Lincoln Park Zoo

- Museum of Contemporary Art

- Museum of Science and Industry

- National Museum of Mexican Art

- National Museum of Puerto Rican Arts & Culture

- Peggy Notebaert Nature Museum

- John G. Shedd Aquarium

Because only one group pass is available at a time, reservations are required. To reserve the free pass, please contact my office at [email protected] or (815) 880-5340. A reservation can be made by providing a name and address, and the date(s) the card would like to be reserved. Upon reserving the pass, constituents may pick it up and return it to my legislative office at 1072 Lake Avenue in Woodstock.